Accounting for Purchase Discounts Entry, Example, and More

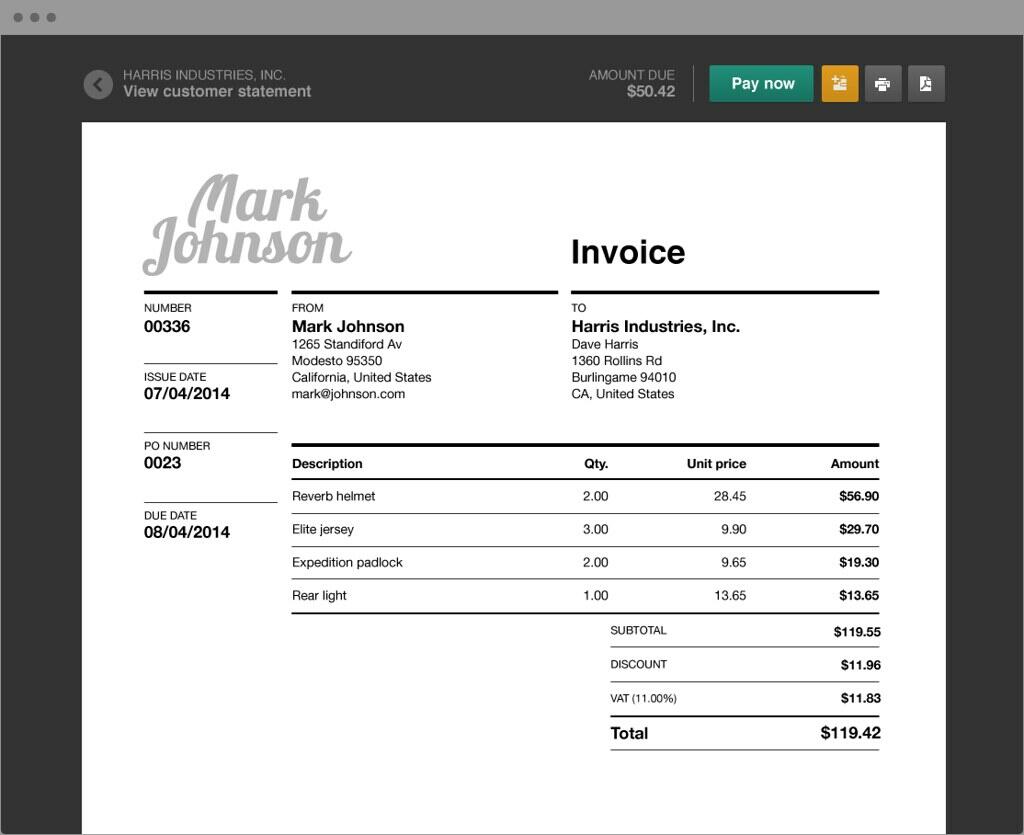

The downside of course is that the business must make payment earlier (10 days instead of 30 days in the above example) and will lose the use of the cash for an extra 20 days. The business pays cash of 1,470 and records a purchase discount of 30 to clear the customers accounts payable account of 1,500. If the business pays the supplier within the 10 days and takes the purchase discount account purchases discount of 30, then the business will only pay cash of 1,470 and accounts for the difference with the following purchases discounts journal entry. The full amount owed to the supplier is shown as a balance sheet liability (accounts payable) and included as purchases or expenses in the income statement.

Financial Controller: Overview, Qualification, Role, and Responsibilities

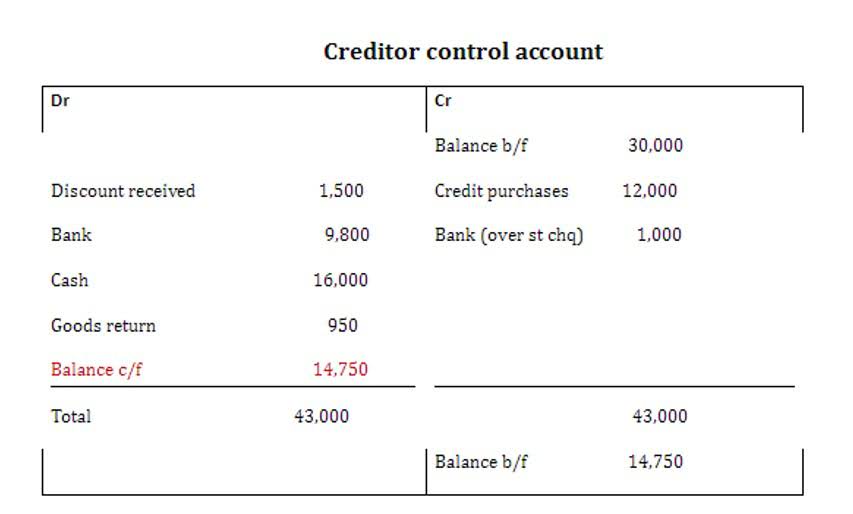

The net method should be used when discounts are taken on purchases from suppliers. This is because it records the effect of the discount at the time of purchase, rather than later when payment is made. In the gross method, we record the purchase of merchandise inventory into the purchase account at the original invoice amount. An aspect that needs to be noted here is that only cash purchase discounts are included as subtractions from gross purchases. At the date of purchase the business does not know whether they will settle the outstanding amount early and take the purchases discount or simply pay the full amount on the due date.

What is Purchase Discounts?

The early payment discount is also referred to as a purchase discount or cash discount. Under periodic inventory system, the company needs to make the purchase discount journal entry by debiting accounts payable and crediting cash account and purchase discounts. When the company makes the purchase from its suppliers, it may come across the credit term that allows it to receive a discount if it makes cash payment within a certain period after the purchase. Likewise, this purchase discount is also called cash discount and the company needs to properly make journal entry for it when it receives this discount after making payment. The journal entry to account for purchase discounts is different between the net method vs the gross method. In the gross virtual accountant method, we record the purchase transaction at the original invoice amount while we record at the net of discount received under the net method.

Journal Entry at Purchase Date

Assume that a company receives a supplier’s invoice of $5,000 with the credit terms 2/10 net 30. The company will be allowed to subtract a purchase discount of $100 (2% of $5,000) and remit $4,900 if the invoice is paid in 10 days. This allows the manufacturers to increase their sales, but it also reduces their cash flow because cash from the sales isn’t being received immediately. This is why vendors traditionally offer purchase discounts to retailers. The retailers are likely to pay the vendors in full before the due date if they will get a slight discount on the price.

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models QuickBooks for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- In this section, we illustrate the journal entry for the purchase discounts for both net methods vs gross method under the periodic inventory system.

- This usually happens when the goods have failed to meet a certain business standard or are obsolete or damaged.

- Cash discounts result in the reduction of purchase costs during the period.

- Net method of recording purchase discounts is a method of recording purchase discounts in which the purchase and accounts payable are recorded at the net of the allowable discount.

- It also helps to ensure that expenses accurately reflect payments made during a period.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- For example, a supplier is offering a 10% discount on the total amount of goods purchased if the buyer settles the payment within 10 days of buying (the full due date of the payment may be 30 days).