Our mission is to provide builders, developers, GCs, and specialty contractors the precision accounting services they need to aggressively grow their businesses and their bottom lines. When you’re looking for a construction industry accountant, DB&B delivers the project level accounting and analysis you need to reduce expenses and increase opportunities for growth. With the team at DB&B, you get a faster turnaround on project level accounting. When you need a construction accountant, why not get a team of certified accountants?

The Marcum Retrospective – Part 6

When you partner with DB&B for construction accounting, you can achieve next level efficiency. You can focus on what you’re good at while our team deals with the number crunching and construction accounting that you need. With consulting services available, we offer an experienced full-service solution for corporations. When you have accurate financial information that you really understand, you have the tools and confidence you need to unlock the true potential and profitability of your construction business. Bookkeeping shouldn’t be the thing that trips up new business owners and entrepreneurs. I offer full service bookkeeping solutions for small businesses so you can focus on customer interactions.

Project Management

Construction companies are also likely to encounter unexpected business expenses that must be paid quickly, so they need access to a larger cash reserve. Our mission is to provide residential and commercial builders and remodelers the precision accounting services they need to aggressively grow their construction businesses and their bottom lines. While our accounting firm is based in Syracuse NY, we have the capabilities, knowledge and experience to provide construction accounting to any organization regardless if you’re 5 miles away or 5,000 miles away. With construction accounting from DB&B, you get more insights with a faster turnaround than in-house accounting without the cost of an employee. Precision accounting for residential or commercial land development companies, weekly comprehensive financial reports via email, and monthly Zoom® financial reports review meetings with your team. Robin L Jordan CPA was established to provide accounting, tax, and business advisory services to corporations, small businesses and individuals throughout the New Gloucester area.

Advisory Director Heather Wilson explores expanded IRS initiatives and investigations for The Legal Intelligencer

- Construction bookkeeping can differ from traditional bookkeeping because construction companies have unique financial needs.

- Now you’re a business owner, which requires a completely different skillset.

- Setting financial goals and creating a budget that supports business expansion is key to long-term success.

- All Bronze services, additional accounting services, basic JobTread®, Buildertrend®, CoConstruct or other CMS platform integration and support, and weekly Zoom® financial reports review meetings with your team.

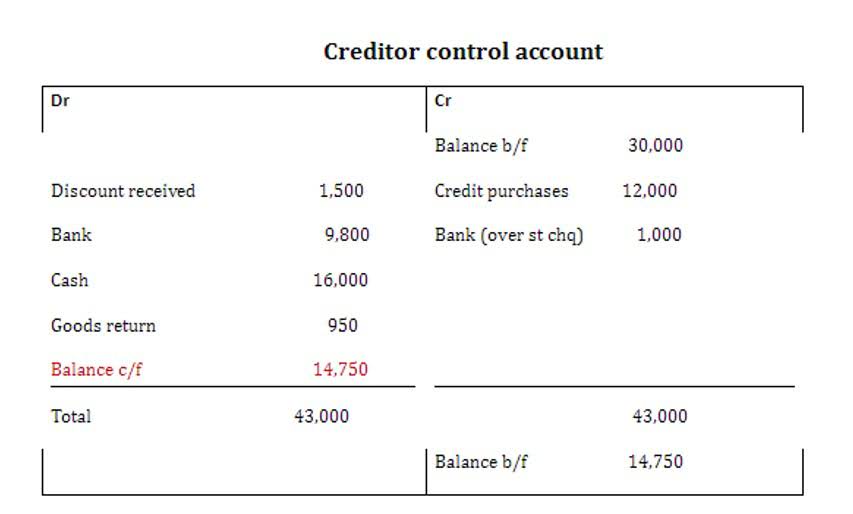

- Reconciling bank statements is an important task ensuring your records match your business account’s actual transactions.

- With DB&B, you have a trusted team of construction accounting professionals who have years of experience and a record of results.

S Corporations & Partnerships – File by March 17th or September 15th with an extension. Please submit all documents to our office by February 1st, to be sure your return is timely filed. Let Apparatus build and operate your Quickbooks® Online accounting system.

Tax & Business

Disclaimer & Privacy… The One River CPAs website and individual One River CPAs Blogs are communication tools of One River CPAs Inc., providing information to firm clients, contacts and visitors. While every effort is made to deliver accurate material, it should not be relied upon as a substitute for independent counsel. Before taking any tax position consult with your tax professional. With IRS representation, CFO-for-hire and consulting services available, we’re here to help you with your specific needs no matter how big or small.

Whether it’s bookkeeping, consulting, or tax prep, we’ve got you covered. DB&B’s outsourced construction accounting services provides you more time to focus on your business while we handle https://azbigmedia.com/real-estate/commercial-real-estate/construction/how-to-leverage-construction-bookkeeping-to-streamline-financial-control/ all your accounting needs. Marcum LLP’s Portland, ME Tax & Business Services division offers all forms of accounting and regulatory compliance services. Our high degree of specialization ensures that both the advice and services clients receive are specific to their needs.

REAL ESTATE PORTFOLIO

This helps you monitor project costs, manage your budget effectively, and ensure you have the right information for tax reporting. Construction The Significance of Construction Bookkeeping for Streamlining Projects bookkeeping services can assist in streamlining this process and ensuring that all expenses are properly documented. Taxes can be a significant burden for contractors if not managed properly. Allocating a portion of your income specifically for taxes helps avoid unexpected liabilities during tax season.